Search Results for "financial inclusion"

Can CBDC Drive Financial Inclusion?

There are still 1.7 billion unbanked in the world. What are the reasons behind such a significant number of unbanked? Can CBDC drive their financial inclusion?

Ripple Donates $10M to Humanitarian Organization to Accelerate Financial Inclusion

Ripple has continued to be innovative in finding ways to deliver global financial inclusion amid a struggling COVID-19 economy.

Nobel Laureate Prof Banerjee - Applying RCT to Financial Inclusion

Economists have long theorized on and sought to implement initiatives to increase financial inclusion. What are some of the policy initiatives developing countries should adopt to drive financial reform? What effect have initiatives had thus far in facilitating this financial transformation? Prof Banerjee will speak at the Asian Financial Forum on January 14th and explain his team's groundbreaking application of randomized control testing to inclusive finance.

Blockchain Experts Discuss: Will Blockchain Be the Missing Piece to Financial Inclusion?

The Singapore Fintech Festival rounded up blockchain discussions on the last day of the festival, focusing on one of the main themes of the event, financial inclusion.

World Bank Pushes to Raise the Bar for FinTech and DLT for Cross-Border Interoperability and Financial Inclusion

The World Bank Group has recently published a study, issued by the Bank for International Settlements (BIS) on “Payment aspects of financial inclusion in the FinTech era,” highlighting the concepts derived using blockchain, including stablecoins, and central bank digital currencies (CBDCs).

Paxful to Boost Financial Inclusion with Its First Crypto Debit Card

Bitcoin trading platform Paxful announced that it will be adding a crypto debit card to its financial services.

World Economic Forum Views Cryptocurrency as Pivotal Tool for Financial Inclusion

The WEF thinks cryptocurrencies can be pivotal in offering financial services to one-third of the world’s adults, approximately 2 billion people, who are unbanked.

Nobel Prize Winning Economist Abhijit Banerjee: Is Blockchain the Key to Financial Inclusion?

While Nobel Prize-winning economist Prof. Banerjee is no expert in blockchain or FinTech services, we went along to the Asian Financial Forum to find out his thoughts on the application of FinTech and Blockchain to facilitate inclusive finance for the developing world. His response surprised us.

UK Media Mogul Calls DeFi a Revolution Against Corrupt Global Banking System

Alexander Lebedev, the billionaire UK media mogul and former banker has endorsed the revolutionary power of DeFi against a corrupt global banking system.

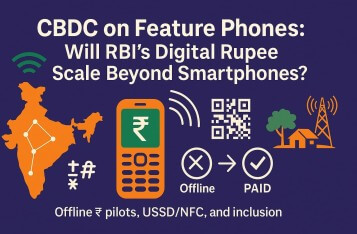

CBDC on Feature Phones: Will RBI's Digital Rupee Scale Beyond Smartphones?

India's digital rupee (e₹) aims to reach feature-phone users, with offline capabilities being tested. Progress exists, but widespread adoption remains a challenge.

Ripple and Onafriq Forge Alliance for Blockchain-Enabled Payments in Africa

Ripple and Onafriq are collaborating to introduce blockchain-powered cross-border payments, aiming to improve transaction efficiency and financial inclusion in Africa, the GCC, the UK, and Australia.

Ripple (XRP)'s 2023 Impact Report: Financial Inclusion and Climate Resilience

Ripple (XRP)'s 2023 Impact Report highlights strides in financial inclusion, blockchain research, and sustainability initiatives.